Gross method vs net method of cash discount definitions, explanations, differences

The discount cannot be taken during the “yellow shaded” days (of which there are twenty). What is important to note here is that skipping past the discount period will only achieve a twenty-day deferral of the payment. There are approximately 18 twenty-day periods in a year (365/20), and, at 2% per twenty-day period, this equates to over a 36% annual interest rate equivalent.

Accounting For Purchase Discounts: Net Method Vs Gross Method

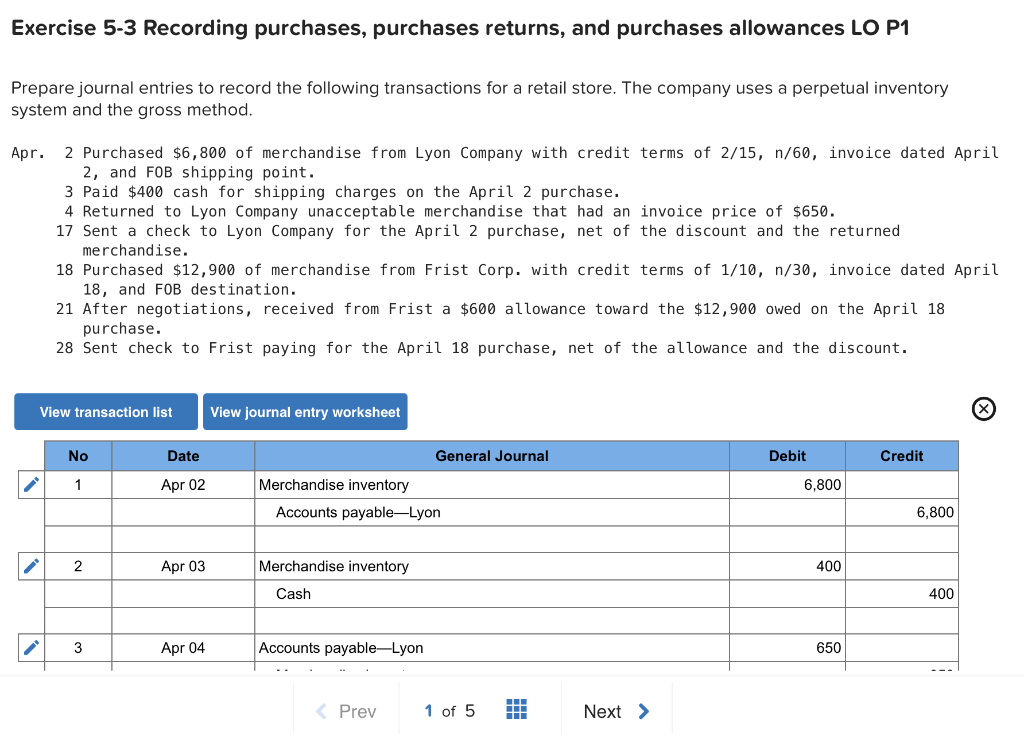

In this section, we illustrate the journal entry for the purchase discounts for both net methods vs gross method under the periodic inventory system. Accounting for purchase discounts, we can be recorded under either the net method or the gross method. Both methods provide the same result; however, the accounting journal entry is slightly different. In both cases, the accounts receivable subsidiary ledger is updated, but not inventory, because we don’t do that under the periodic method. The Bryan accounts receivable subsidiary ledger now shows that Geyer owes $16,700, and a call or letter to Geyer would verify that their accounts payable matches if they are using the gross method.

Would you prefer to work with a financial professional remotely or in-person?

- Explore the nuances of the net method in financial accounting, highlighting its principles and transaction recording techniques.

- O If goods are sold F.O.B. shipping point, freight prepaid, the seller prepays the trucking company as an accommodation to the purchaser.

- In the U.S., the F.O.B. point is normally understood to represent the place where ownership of goods transfers.

- Consequently, if a business does not do a good job of taking all early payment discounts, it should not use the net method.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Accounts payable are recorded at their expected cash payment at the time of purchase. If the payment is made within the discount period, Accounts Payable should be debited, and Cash should be credited for the amount at which the payable was originally recorded. For example, if there was a 2% discount on the above purchase, it would amount to $200 ($10,000 X 2%), NOT $208 ($10,400 X 2%).

Related AccountingTools Course

The net method in financial accounting offers a streamlined approach to recording transactions, particularly when dealing with discounts and payment terms. It provides a more accurate representation of cash flow and financial health by recognizing potential savings upfront, leading to improved decision-making for businesses focusing on cost management and efficiency. Another important consideration when using the net method is the treatment of uncollectible accounts. Since the net method records transactions at their net amounts, any subsequent realization that a receivable is uncollectible requires adjustments to the financial statements.

What is the Net Price Method?

By recording this adjustment, the accounts payable need to be adjusted back to the full invoice amount. Acas provide free and impartial advice to employers and workers on employment matters. The net method works by recording any purchase discounts obtained from suppliers as an immediate offset to the cost of goods purchased. Net method of recording purchase discounts is a method of recording purchase discounts in which the purchase and accounts payable are recorded at the net of the allowable discount. The gross method may inflate sales and purchase figures initially, potentially skewing metrics such as profit margins and return on sales. This can provide a different perspective on operational efficiency and profitability compared to the net method, where discounts are embedded in the initial transaction entries.

Effect if cash discount not availed

This is usually expressed as a percentage and is typically provided for in the terms of sale. Some may post the charge as an offset to the expense, as an offset to a payable, or as an income item. The F.O.B. point is normally understood to represent the place where ownership of goods transfers. From 1 January 2024 the following principles relating to the carryover of annual leave apply.

In the gross method, we normally record the purchase transaction at a gross amount. These retailers can usually receive a discount for paying in cash since the manufacturers and wholesalers don’t want to have outstanding accounts receivable. On the other hand, the purchaser adds accounting basics for an llc the inventory on receipt (and the seller removes the item from inventory when it arrives with the purchaser) if the policy was FOB destination. Let’s assume here that Bryan posts shipping charged to customers to a revenue (income) account called Shipping billed to customers.

In the U.S., the F.O.B. point is normally understood to represent the place where ownership of goods transfers. Along with shifting ownership comes the responsibility for the purchaser to assume the risk of loss, pay for the goods, and pay freight costs beyond the F.O.B. point. Both merchandising and manufacturing companies can benefit from perpetual inventory system. Explore the nuances of the net method in financial accounting, highlighting its principles and transaction recording techniques. This approach can significantly impact how companies report their finances, offering potential benefits in terms of accuracy and clarity.