What Are The Kinds Of Forex Brokers? By Forex_class

ECN brokers usually cost a commission on each trade, in addition to the unfold. Although this may lead to greater transaction prices compared to market makers, ECN brokers supply larger transparency and extra accurate pricing. They additionally permit for using superior buying and selling strategies, similar to scalping and hedging. The instructional section also wants to present instruction on the broker’s buying and selling platforms, currency pairs, and market order sorts. Look for movies, manuals, or different tutorials that present you tips on how to build customized watchlists, arrange technical charts, and show easy-to-read quote screens.

- A long place opens a commerce that makes money when the exchange fee strikes larger; quick sale earnings when it moves lower.

- trade.

- However, not like ECN brokers, STP brokers do not cost a commission on each commerce.

- Forex brokerscome in several types, starting from probably the most respectable brokerage firms to betting homes that work illegally.

Before hopping on a trading platform, you might need to create a finances for your funding life. Figure out how a lot you want to invest, how a lot you are keen to pay for fees, and what your targets are. There are a lot of factors to discover whereas choosing the proper platform for you. Each broker that features foreign exchange investments has advantages and drawbacks. Some of an important things to think about are regulation, the level of safety supplied by these firms, and transaction charges.

Working with a dealing desk is a wise move for starting and skilled merchants who don’t wish to trade directly with liquidity providers. This is a normal operating process as a end result of most foreign exchange brokers charge no commissions or charges forex broker types for commerce execution, as an alternative relying on the bid/ask unfold as their main supply of earnings. ECN brokers present direct entry to the interbank market, the place traders can interact with other members.

Buyer Assist And Status

clients’ trades by matching each commerce in full within the underlying market. When there is no dealing desk, the corporate might only profit from the dealing spread per commerce. They may have no monetary interest in whether your

narrower than these utilized by everyday brokers, ECN brokers cost shoppers a fastened fee per transaction. Market maker brokers, also called dealing desk brokers, are the commonest sort of forex brokers. They create a market for their shoppers by taking the other side of their trades.

This makes them a preferred selection amongst traders who prioritize tight spreads and environment friendly order execution. Like ECN brokers, they supply traders with direct entry to the interbank market, eliminating potential conflicts of curiosity. However, in distinction to ECN brokers, STP brokers do not cost a commission on every commerce. Another variation is the hybrid broker, which combines an STP or ECN with its personal market-making dealing desk. This sounds ominous till you notice that liquidity suppliers actually do not wish to work with micro quantities, and the dealer has committed to orders of a minimal dimension. By including its own market maker desk to the system, the dealer is prepared to accommodate the little man.

The Three Main Kinds Of Foreign Exchange Brokers

in the underlying market itself. They will provide a quote based on the underlying market worth, and then sit on the other aspect of the client’s commerce.

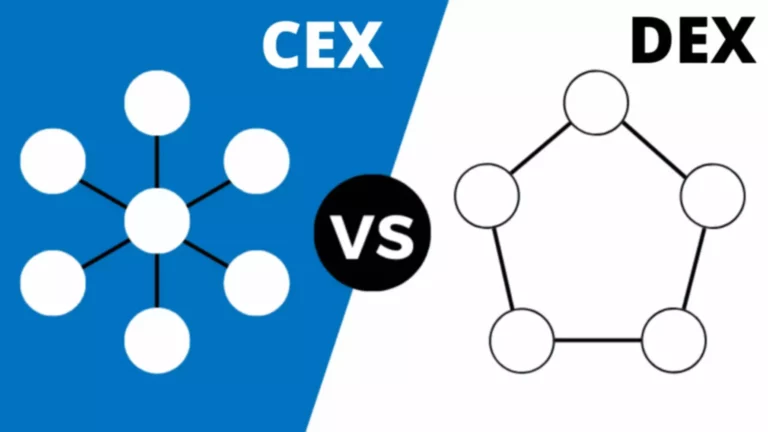

In this article, we are going to explore the different types of forex brokers that will assist you make an knowledgeable determination. A Forex trading broker is organized as either a dealing desk (also called market makers) or a non-dealing desk.

Is Octafx A Great Forex Dealer

spreads than could be in any other case out there to them. The U.S. foreign exchange trade makes use of “introducing broker” and “white label” categories to market its services and build its companies. The introducing broker denotes a smaller operation that refers clients to a big broker in change for rebates or other incentives.

This, in fact, brings up all of the familiar stories about your broker trading towards you when your positive aspects begin getting sizeable. It is conceivable that after you’ve been buying and selling for a while, the dealer has gotten a profile of you and can allocate your trades to the STP aspect of its shop or the market-maker side. An genuine advantage of STPs is that they provide micro lot sizing, while most ECNs require standard lot sizes, though these days, ECNs come in all sizes. If your STP has its own dealing desk (making it a “hybrid”), you could be back to turning into fearful that your broker is manipulating prices or fills against you.

What Is A Foreign Exchange Broker?

On the other hand, STP brokers route traders’ orders directly to liquidity providers. Market Makers, quite the opposite, act as counterparties to merchants’ positions, making a market for them. Market makers usually offer fastened spreads, which implies that the difference between the buying and selling costs remains constant no matter market conditions. While this offers traders with certainty when it comes to transaction costs, it additionally means that market makers have the potential to control prices to their benefit.

When it involves buying and selling within the foreign exchange market, some of the essential decisions you might make is selecting the best foreign exchange dealer. A foreign exchange dealer acts as a intermediary between you, the trader, and the interbank market the place currencies are traded. They provide you with a platform, entry to liquidity, and different important companies necessary for successful buying and selling.

They cost a fee on each traded quantity to earn income from working with traders. ECN brokers also permit traders to process all their transactions in the interbank market. With a real No Dealing Desk broker, there is not any re-quoting of costs, which implies you could commerce during economic announcements with none restrictions. The spreads provided are lower, however they are not fastened, to permit them to enhance significantly when volatility is increasing during major financial bulletins.

Foreign Foreign Money Trading: What You Have To Know

The best social hubs will function some type of rating system that enables purchasers to access the most prolific members with ease. These contacts can be enormously helpful in customizing buying and selling platforms, which frequently function API interfaces that enable third-party add-ons. It’s much more useful when the broker offers a complete add-on library, with contributions that make trade administration an easier task. Forex quotes display two ratios, a better asking worth and a decrease bid value. The last two decimals are often drawn in very large print, with the smallest price increment known as a pip (percentage in point). Profits and losses are calculated by the number of pips taken or misplaced after the place is closed.

Meanwhile, wider spreads are typically insignificant to longer term swing or position merchants. Working with brokers of this nature often