7 3: Methods Under a Periodic Inventory System Business LibreTexts

The products in the ending inventory are either leftover from the beginning inventory or those the company purchased earlier in the period. LIFO in periodic systems starts its calculations with a physical inventory. In this example, we also say that the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. We use the same table (inventory card) for this example as in the periodic FIFO example.

Which Companies Use The System?

Beginning inventory and purchases are the input that accountants use to calculate the cost of goods available for sale. They then apply this figure to whichever cost flow assumption the business chooses to use, whether FIFO, LIFO or the weighted average. Complete the closing entry at the end of the accounting period, after the physical count. should taxes on stock influence your decision to buy or sell You can calculate the COGS by using a balancing figure or the COGS formula. In this entry, the debits are in the ending inventory rows and the COGS row, and the credits are in the beginning inventory and the purchases rows. Record the purchase of inventory in a journal entry by debiting the purchase account and crediting accounts payable.

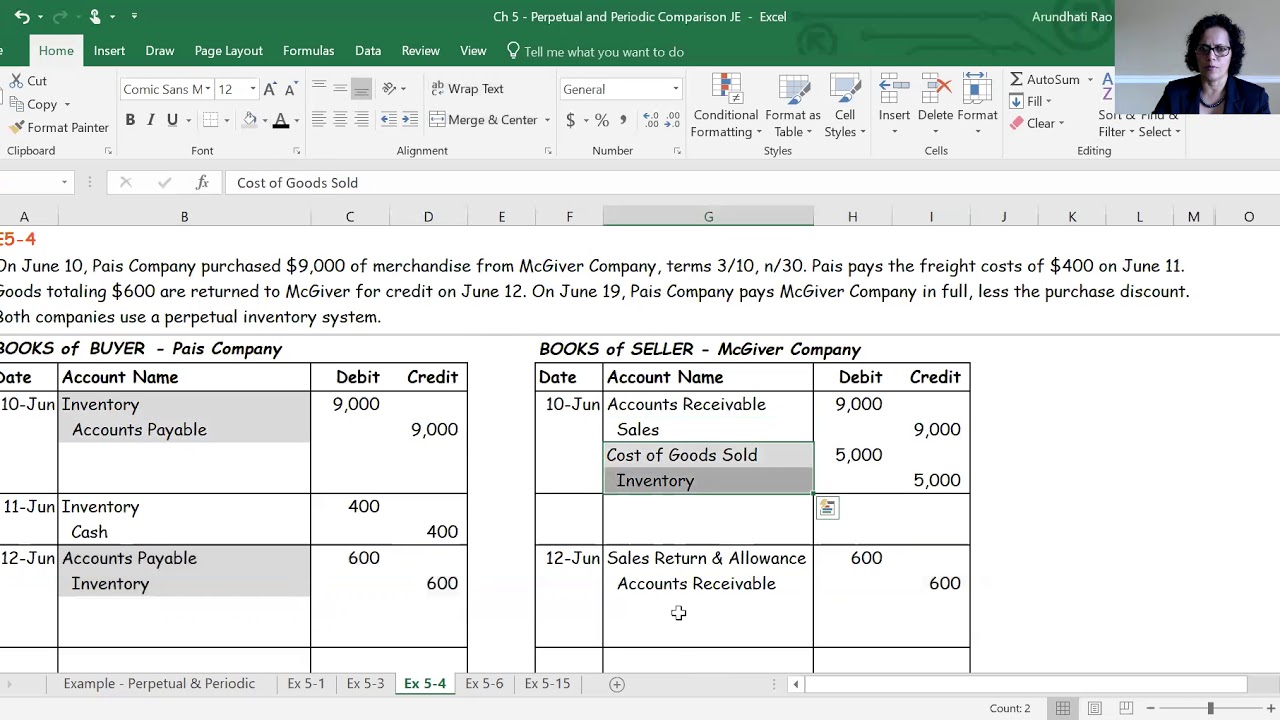

Journal Entries for Periodic Inventory

In a perpetual system, you immediately enter the new pallet in the software so the system can track its life in your business. When there is a loss, theft or breakage, you should also immediately record these updates. The total inventory value is the cost (or total price) of goods that are able to be sold – minus the total number of goods sold between physical inventories. The physical inventory count is then completed, and compared to the value calculated. A variation on the last two entries is to not shift the balance in the purchases account into the inventory account until after the physical count has been completed.

- When paying for inventory purchased on credit, we will decrease what we owe to the seller (accounts payable) and cash.

- However, during the counting process, the accurate aand updated information of the inventory level will not be present.

- Therefore, before any adjusting entries, the balance in the merchandise inventory account will reflect the amount of inventory at the beginning of the year, as indicated in the following T-accounts.

- The adjusting entry is based on the formula to calculate the cost of goods sold.

How to Calculate Periodic Inventory

The adjusting entry is based on the formula to calculate the cost of goods sold. Thus, the purchases and merchandise inventory (beginning) are added together and represent goods available for sale. Record sales discount by debiting the sales discount account and crediting the accounts receivable account. The periodic inventory system is a software system that supports taking a periodic count of stock.

Under the perpetual method, cost of goods sold is calculated and recorded with every sale. Under the periodic inventory method, cost of goods sold is calculated at the end of the period only and recorded in one entry. Companies would normally use a periodic inventory system if they sell a small quantity of goods and/or if they don’t have enough employees to conduct a perpetual inventory count. Small businesses, art dealers, and car dealers are several examples of the types of companies that would use this accounting method.

For the manufacturer, it refers to the raw material, work in progress, and finished products as well. Inventory is the assets that a company will sell to generate revenue for the business. Periodic inventory is the inventory control system that does not keep track of the inventory balance and cost of goods during the month. When using the perpetual system, the Inventory account is constantly (or perpetually) changing. Below is a break down of subject weightings in the FMVA® financial analyst program.

At the same time, we need to reverse last month’s inventory balance otherwise it will double count. To maintain consistency, we’ll use the same example from FIFO and LIFO above to the calculate weighted average. In this example, the physical inventory counted 590 units of their product at the end of the period, or Jan. 31.

A perpetual system is superior to a periodic system in many ways, especially for companies that are considering their longevity. Implementing a perpetual system earlier in the company’s inception enables staff to have a long-term record of the inventory and also keeps the business from growing out of a periodic system one day. A perpetual system can scale, so whether you have five products (today) or 200 products (tomorrow), a perpetual system can effectively manage inventory control.